London, UK, 20th April 2020 / MicrofluidX announces it has raised £1.4m in seed funding from leading seed investors UK Innovation & Science Seed Fund (UKI2S), Longwall Ventures and Moulton Goodies Limited with angel contributions from 88 Capital and Cambridge Angels. The Company will develop its novel cell bioprocessing technology, utilising microfluidics to tackle the challenges associated with bioprocessing for cell and gene therapy.

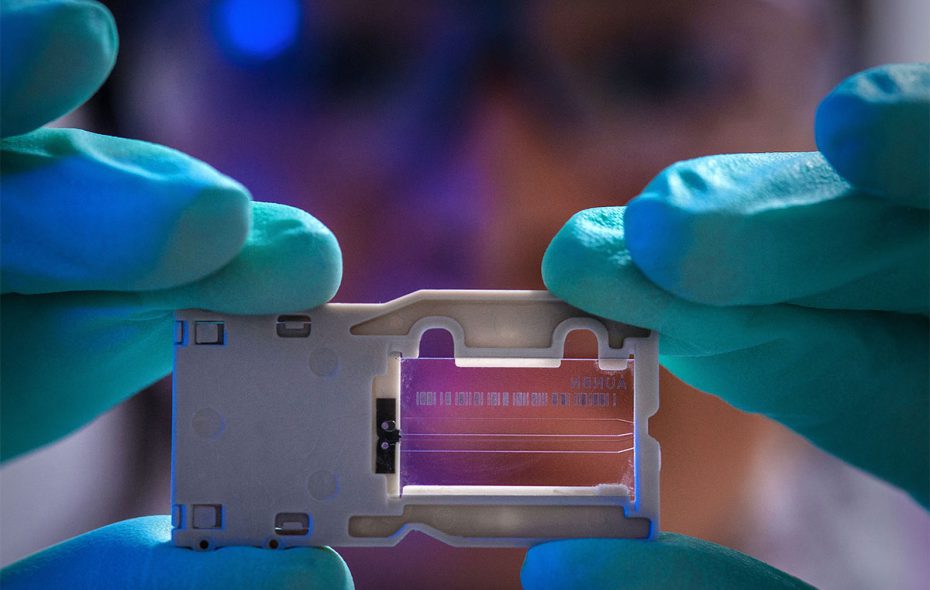

MicrofluidX leverages the power of microfluidics to overcome the challenges of bioprocessing in the production of cell and gene therapies. Its novel technology facilitates process development by running dozens of cell culture conditions in parallel with precise process control and enables seamless scale-up to several billion cells for manufacturing at a fraction of the current costs. The funding will enable the Company to build a working prototype that can be used to generate comparative biological data between this new platform and conventional single-use technologies.

Antoine Espinet, Founder and CEO of MicrofluidX, commented, “We are thrilled to close this initial funding round with help from UKI2S. We are continuing to establish partnerships with Biotech and Pharma, on top of our existing partnerships with the Cell and Gene Therapy Catapult and the Centre for Process Innovation. The funding will be used to further develop our technology, as well as fund trials with our partners.”

Pablo Lubroth, Investment Manager at UKI2S, added, “There is a clear unmet need in cell and gene therapy manufacturing. The key issues such as cost-of-goods, batch variability and scalability can all be addressed using MicrofluidX technology. The downstream effects of solving these manufacturing problems will lead to cheaper advanced therapeutics and faster manufacturing timelines and in turn increase the adoption of these disease modifying and life changing therapies.”

ENDS

About the UK Innovation & Science Seed Fund (UKI2S)

UKI2S is a national seed investment fund that helps the UK to build innovative businesses, leverage private investment and grow jobs. UKI2S achieves this by nurturing new businesses arising from the great science undertaken in the UK; providing the patient, long-term committed capital and strategic advice these companies need. UKI2S is usually a founder investor and often the sole investor in the very earliest stages. Over the past decade and more UKI2S has built a substantial track record with 57 portfolio companies created – with only £15m of capital from UKI2S – that between them have attracted over £500m of later stage investment and now have a combined market value of over £750m. UKI2S works closely with its partners – led by STFC, BBSRC and NERC, which are all part of UK Research & Innovation (UKRI) and Dstl – and is aligned with the Catapults and Innovate UK to create the best environment for innovation to flourish and in turn, boost the UK’s competitiveness and productivity by commercialising key technological advances in industrial biotech, ag tech, healthcare, medicine, clean energy, materials, artificial intelligence, software and space. UKI2S is independently managed by specialist venture capital firm Midven www.midven.co.uk

For more information, please visit www.ukinnovationscienceseedfund.co.uk.

About Longwall Ventures

Longwall Venture Partners LLP is a venture capital firm investing in innovative, UK based, early stage companies in the healthcare, science and engineering sectors. Based on the Harwell Campus, a leading science, innovation and technology park, located just south of Oxford, Longwall manages three funds: the £30m Oxford Technology ECF, the £40m Longwall Ventures ECF and the £75m Longwall Ventures 3 ECF, which it is currently investing. The Longwall portfolio comprises companies in a range of sectors including scientific instrumentation, next generation sequencing, next generation PV, cancer diagnostics and drug delivery systems, digital health, satellite robotics, IoT security, radar, oil drilling tools and organ perfusion. Longwall Venture Partners LLP is authorised and regulated by the Financial Conduct Authority.

http://www.longwallventures.com

About Cambridge Angels

Cambridge Angels is a leading UK business angel network with international connections.

Cambridge Angels is a collaborative Cambridge-based group, actively mentoring and investing in innovative entrepreneurial teams and their ideas, to achieve returns and help realise their full potential. The group has a strong ethos of backing merit and supporting entrepreneurship.

Members, most of whom are successful entrepreneurs, invest in a wide range of start-up and scale-up businesses with a particular focus on technology, internet, software, hardware, and tools and technologies supporting healthcare.

UKI2S

Dr Andrew Muir UKI2S

T: 0121 710 1990

M: 07968 298816

E: andrew.muir@midven.co.uk

PR Contact

Juliette Craggs/Richard Anderson

Sciad Communications

T: +44 (0)20 3405 7892

M: +44 (0)7815 641135

E: UKI2S@sciad.com